Recurring Deposit:

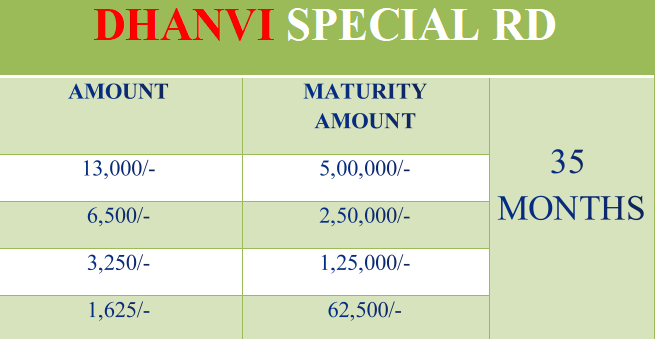

Benefits: RD helps to accumulate funds for short term or long term by saving monthly. In this RD account you can deposit your investment from minimum 500 rupees to maximum big amount every month depending on your budget. This deposit is very useful to get more amount of savings with less investment. Account holder can invest flexible amount in each interval as per convenience. You can get the principal and interest you get in cash or gold..

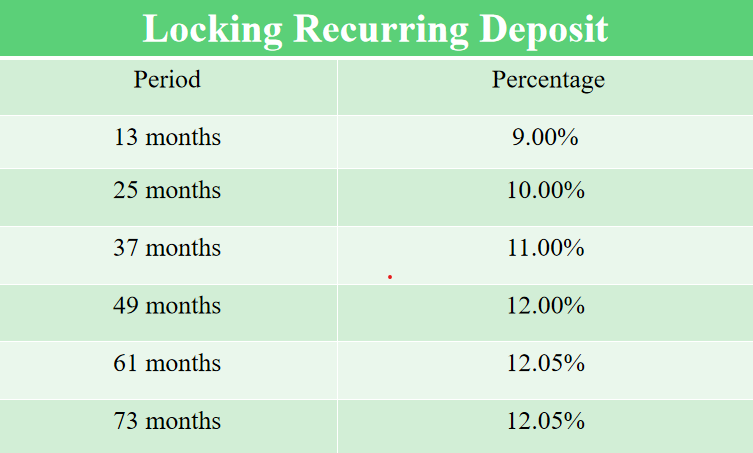

Tenure Period: 13 Months – 73 Months

ROI: Min 9% – Max 12.5%

Eligibility: Any Individual, No Age Limit.